Information Disclosure Based on the IFRS Sustainability S2 Disclosure Standards

Basic Concept

The IDEC Group has been conscious of eco-friendliness since its foundation in 1945 through it's “Save all” and “Pursuit of saving” by words. We have formulated “The IDEC Way” in 2019 and have since been maintained a management focus on environmental issues and reduction of environmental impact through the realization of safety, ANSHIN, and well-being. Responding to climate change is a major societal challenge globally.

We identify responding to climate change as one of our priority issues. Having set the Vision for 2030 in the Materiality, we are promoting various initiatives aimed at achieving a sustainable society.

The IDEC Group has disclosed climate-related information based on the TCFD (Task Force on Climate-related Financial Disclosures) since FY2022. This year, we disclose climate-related information based on the IFRS (International Financial Reporting Standards) S2 that succeeds the TCFD recommendations.

Governance

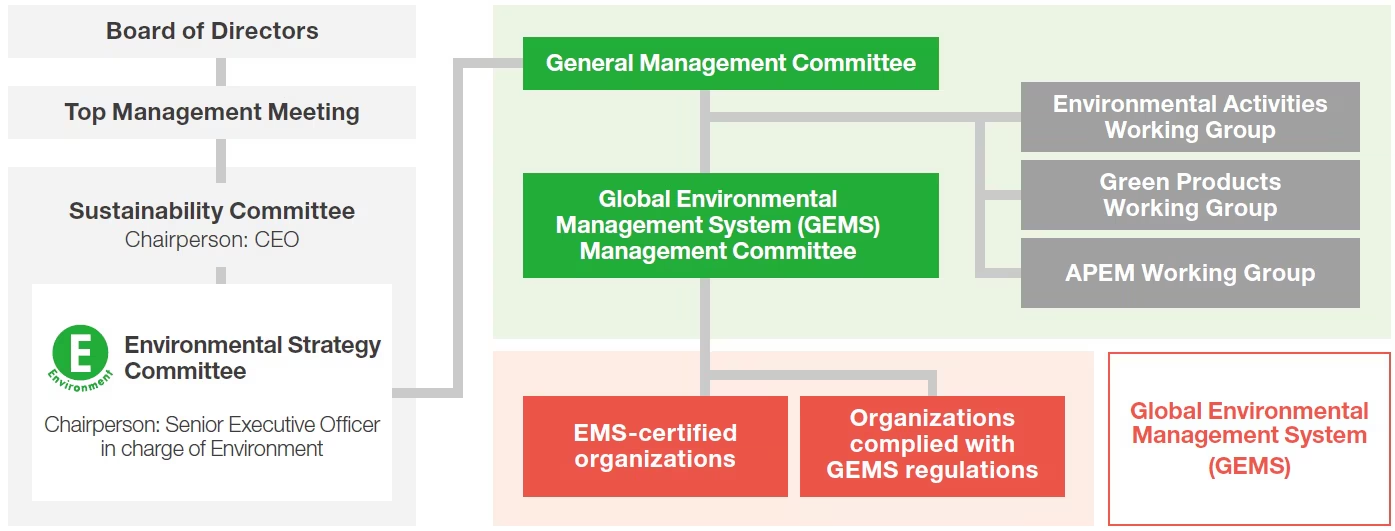

The Environmental Strategy Committee, a specialist committee of the Sustainability Committee chaired by the CEO, plays a key role in our efforts to disclose climate-related financial information.

The Environmental Strategy Committee is composed of employees from various departments, and meets every other month under direction by the Senior Executive Officer in charge of the Environment. Decisions made by the Environmental Strategy Committee are discussed by the Sustainability Committee, reported to the Top Management Meeting for approval, then reported to the Board of Directors for final approval. Progress on the goals set in the medium-term management plan started in FY2026 are reviewed at the meetings every other month, and response measures are discussed if things are not progressing as planned.

As part of our global governance structure, in FY2025 we established and launched a Global Environment Management System Steering Committee. The committee consists of members from IDEC head office, domestic group companies, and bases in Suzhou, Taiwan, and Thailand, and each APEM site (France, UK, Denmark, Tunisia and USA) and holds quarterly Steering Committee meetings. The committee checks progress on environmental issues, shares information on topics such as waste, eco-friendly materials, and the introduction of recycled plastics, and discusses environmental issues.

Framework of the environmental governance

Departments responding to climate change and each role

| Name | Function | Number of Meeting |

| Board of Directors | Supervision of important matters related to climate change | 7 times per year* |

| Top Management Meeting | Decision making of important matters related to climate change | 8 times per year* |

| Sustainability Committee | Review of important items relating to climate change, and submission of those to the Top Management Meeting | Twice a year |

| Environmental Strategy Committee | Management of climate-related opportunities | Once a month |

| Risk Management Committee | Management of climate-related risks | Twice a year |

| Executive Officer in charge | Senior Executive Officer in charge of the environment | |

| Responsible Department | Strategic Planning, Environmental Promotion, Accounting, CSR, HR&GA | |

Strategy

The IDEC Group regards environmental strategy as an integral part of its business strategy, and has incorporated eco-friendly products into its transition plan starting in FY2026 by introducing sales targets for eco-friendly products as KPIs. This will enable us to systematically improve the level of environmental contribution of our business activities.

We are also accelerating the development of our value chain with suppliers by setting supply chain engagement rate as a KPI and revising CSR procurement and green procurement guidelines. In addition, we are continuously engaged in various environmental initiatives, including reducing CO2 emissions to achieve carbon neutrality, reducing industrial waste, and increasing recycling rates.

These transition plan-related activities align with the IDEC Group's purpose of contributing to the realization of safety, ANSHIN, and well-being for people worldwide, as a harmonized approach to environmental considerations. In addition, ESG-related information, including disclosures based on the TCFD Recommendations, has been included in our Securities Report since of FY2024.

Climate Resilience

The World Energy Outlook 2024 (WEO2024) report published by the International Energy Agency states that due to global geopolitical tensions and divisions, the world faces energy security risks, which pose major risks to concerted efforts to reduce emissions.

While geopolitical risks abound, the report explains that the fundamental balance of the market is loosening, setting the stage for fierce competition between different fuels and technologies. Momentum for clean energy remains strong and is expected to lead to a peak in demand for various fossil fuels by 2030.

Based on these conditions, the IDEC Group’s selection scenarios for FY2025 are the same as in FY2024, and the transition risk scenarios are the WEO2024 STEPS (2.6°C scenario) and NZE (1.5°C scenario). For our physical risk scenarios, we adopt RCP2.6 (2°C scenario) and RCP8.5 (4°C scenario) of the IPCC Fifth Assessment Report.

Source:WEO2024 issued by IEA

Based on our selected scenarios, we held workshops at IDEC head office and GEMS Steering Committee members’ countries and regions in FY2025 to analyze risks and opportunities together with team members from various departments. In our workshops, we used the International Energy Agency's World Energy Outlook 2024 (WEO2024), IFRS S2 and industry-specific disclosure topics, CSRD/ESRS, and the Materiality Assessment Implementation Guidance (MAIG) as reference materials for risk and opportunity assessments.

Findings were categorized into transition and physical risks, time-related impacts, and potential financial impacts, and organized into our 1.5°C/2°C and 4°C scenarios.

Risk management

For each of the climate-related risks and opportunities identified by the Environmental Strategy Committee, we considered the likelihood of occurrence, degree of impact, and amount of potential financial impact, and compiled them into a risk and opportunity map. The identified results and risk items that have been assessed as important in our mapping are managed by referring to an integrated risk map for the IDEC Group. They are also reflected in the risks and opportunities associated with natural capital, one of our materialities.

The Environment Promotion Department lists environmental risk management items on an annual risk management table, specifies performance indicators, and reports the state of achievement to the Risk Monitoring Subcommittee.

Strategy: Climate change risks and opportunities

Based on our scenarios and other findings from risk and opportunity workshops conducted in Japan and other countries participating in the Global Environmental Management System, we identified transitions and physical risks and opportunities reasonably expected to have an impact on IDEC Group's outlook.

Next, we calculated the probability of occurrence, degree of impact, and potential financial impact for each risk and opportunity item, and updated our climate-related risk and opportunity map. Details summarizing the potential financial impacts of risks and opportunities and measures to address them is scheduled to be disclosed later.

Descriptions of risk items

①Increase in raw material costs

②Growing environmental awareness among customers and investors

③Delay in relative to competitors in the transition of existing and new products to low-emission/low-carbon technologies

④Tendency of carbon pricing

⑤Natural disasters (heavy rain, hail, snow/ice, cyclones, hurricanes, typhoons, floods, inundation, earthquakes) and temperature rise

Descriptions of opportunity items

①Demand for low-emission products and a diverse variety of new products and services through R&D and technological innovation

②Shift to alternative materials / diversification / new technologies

③Transition to distributed energy generation and the creation of new markets

The world images assumed in each scenario are summarized as below.

The Image of the world in +1.5℃ and 2℃

Transition Risks | Great increase carbon tax (carbon price) |

Opportunities associated with Transition | Business opportunity for new energy |

Physical Risks | Increase temperature (+2.0℃) |

The Image of the world in +4℃

Transition Risk | Increase movement restriction |

Opportunities associated with Transition | Develop and prevail protective clothing for environment |

Physical Risks | Great increase temperature (+4.0℃) |

Risks and Opportunities

In an effort led primarily by the Environmental Strategy Committee, we have identified risks and opportunities that could reasonably be expected to affect the outlook of the IDEC Group in reference to the risks and opportunities items of the CDP Climate Change Questionnaires, one of the global standards for environmental information disclosure. Referring to and considering the applicability of the industry-specific disclosure topic (Electrical & Electronic Equipment industry) as defined in the IFRS S2 Industry-based disclosure requirements, we identified transition risks and physical risks, impacts of climate-related risks and opportunities that can reasonably be expected to occur over any short to long-term period, potential

financial impacts, and defined timeframes.

Major risk list

|

Category |

No. |

Item |

Potential |

Anticipated risks |

IDEC Group's responses |

|

|

Tran- |

Market | ❶ | Increase in raw material costs | B/E | ・Suspension of factory operations and transportation delays due to global natural disasters and human disasters, etc. ・Resulting shortages of parts and materials, and resulting chain of increased transportation, labor, and energy costs ・ Eco-friendly materials, low environmental impact materials and technologies |

・Transfer costs in response to price increases by continuously increasing mutual understanding with suppliers and customers. |

| ❷ | Growing environmental awareness among customers and investors | C/D | ・Declining demand and damage to corporate value due to growing criticism of products and initiatives with high environmental impact ・Increased weight of services as a factor in purchasing decisions ・Rapid changes in trends within the industrial products sector ・Declining trust from stakeholders |

・Position environmental strategy as one of the priority items in the medium- to long-term plan, set materiality KPIs relating to the environment, such as increasing the cumulative ratio of eco-friendly products among new products, and check progress. |

||

| Tech- nology |

❸ |

Delay in relative to competitors |

C | ・Rapid emergence of new products that generate added value through environmental response in the industrial products sector and increasing customer needs for such products ・Enactment of new regulations on GHG emissions ・Increased risk of industrial equipment failures due to climate change |

・Systematically incorporate technologies that we do not have and integrate them with our core technologies through long-term collaboration with other companies. ・Obtain information at an early stage through regular monitoring of regulatory information, and establish a system that allows for reflection of this information in business strategies and product development ・Enhance the durability of equipment and devices to adapt to extreme weather and global warming caused by climate change |

|

| Regu- ration |

❹ | Tendency of carbon pricing | B/E | ・Accelerated global momentum for climate change measures and reduced CO2 emissions, with governments around the world introducing carbon taxes ・Introduction of carbon pricing in Japan (from 2028 onward), with carbon taxes being added to energy prices, leading to increased manufacturing costs for raw materials ・Decline in profitability due to stricter regulations and mandatory energy conservation targets |

・Plan and implement planned upgrades to energy-saving equipment. ・Reduce indirect costs through efforts to save energy and improve the operating rate of factories. ・Drive decarbonization activities through the introduction of ICP. ・Invest in technologies necessary for reducing emissions, and introduce a system for regularly managing emission reduction targets |

|

|

Physi- |

Urgent or chronic |

❺ | Natural disasters and temperature rise | D | ・Increased frequency of natural disasters such as localized heavy rainfall, cyclones, hurricanes, and typhoons caused by global warming, and extreme changes in rainfall and weather patterns ・Decline in production activities (power shortages, equipment damage, inability of employees to come to work, etc.) and supply chain disruptions due to frequent occurrence of disasters such as abnormal weather conditions worldwide ・Spread of new viruses and other infectious diseases due to climate change ・Increased cooling costs and decreased productivity due to rising temperatures, and disruption of transportation networks due to prolonged cold weather |

・Enhance BCP measures to enhance the company's resilience. ・Assess and review to supply chain risks. ・Prepare hazard maps of manufacturing sites and find potential risks, and formulate disaster prevention plans tailored to each region ・Formulate recovery plans for each site and develop manuals for employee work procedures ・Diversify production bases for mainstay products |

A: Increase in direct costs B: Increase in direct and indirect costs C: Reduced sales due to decreased demand for products and services D: Reduced sales due to decreased production capacity E: Increase in capital expenditure

Major opportunity list

| Category | No. | Item | Potential financial impact | Anticipated opportunities | IDEC Group's responses |

| Resource efficiency | ❶ | Demand for low-emission products and a diverse variety of new products and services through R&D and technological innovation | B/A | ・Increased demand for recycling accompanying effective utilization of resources ・Increased demand for products with low emissions throughout the product life cycle ・Political measures such as GX bonds and subsidies ・Selection of suppliers based on the extent of GHG emissions reduction | ・Accelerate technological innovation taking environmental aspects of main product lines into account ・Research applications of easily recyclable materials to products ・Secure a first-hand advantage by accelerating investment in development ・Introduce Life Cycle Assessments (LCA) |

| ❷ | Shift to alternative materials / diversification / new technologies | B | ・Increased demand for new technological innovations to address various changes in working environments caused by climate change ・Diversification of working environments and development of unmanned and remote technologies due to the decline of the working-age population ・Popularization of robots in harsh and dangerous working environments ・Increased sales of automation systems driven by demand for labor reduction | ・Shift away from extrapolations of existing technologies ・Engage in M&A and business alliances, strengthen software and system-related technologies through recruitment and training of human resources ・Promote the incorporation of new technologies to respond to diverse needs through partnerships and collaborations with other companies and academic organizations. ・Develop products utilizing HMI and sensing technologies, and propose solutions through systematization and packaging. | |

| Products and services | ❸ | Transition to distributed energy generation and the creation of new markets | A | ・Progress in transition measures in response to global climate change ・Utilization of clean energy other than electric power, and increased demand for labor-saving technologies and energy-saving products ・Launch of various renewable energy development and energy conservation projects as measures to reduce emissions | ・Enter new markets, engage in technological innovation, and secure competitive advantages ・Develop products utilizing HMI and sensing technology, and propose problem-solving solutions based on the needs of new markets. ・Implement localization strategies that provide products and services tailored to regional characteristics |

A: Increased sales through entry into new and developing markets B: Increased sales as a result of increased demand for products and services

Metrics and targets

To reduce CO2 emissions, in our medium-term plan we have set the targets of reducing Scope 1 and Scope 2 CO2 emissions by 35% by FY2028 and 50% by FY2031 (both compared to FY2020). The internal carbon price (ICP) introduced in FY2023 has been set at 14,000 yen/t for FY2026. While the impact of ICP on environmental investment decision-making is not yet sufficient, the Environmental Strategy Committee is working to raise awareness within the Group by introducing model cases of ICP utilization on the intranet.

With the Performance Share Units (PSUs) introduced into the executive compensation system in FY2024, approximately 10% of compensation may be allocated to directors and executive officers in the form of common stock, with non-financial indicators being used in the calculation of PSUs. Our return on carbon (ROC) profit ratio, which indicates how much CO2 was reduced and how efficiently profits were earned, has continued to decline in line with the decrease in operating profit.

In terms of CO2 emissions for FY2025, total Scope 1 and Scope 2 emissions decreased in comparison with FY2024. We have been successful in continuously reducing emissions since FY2023.

While we do not plan to add solar power generation equipment in FY2026, the on-site power generation equipment introduced at Tatsuno Distribution Center in FY2025 is now in operation, and will contribute to reducing CO2 emissions in FY2026. In addition, we expect to see CO2 reduction benefits from switching to electricity with lower emission factors and achieving improved operating rates at each factory.

With regard to Scope 3 emissions, we will continue to implement eco-friendly considerations—such as energy-saving design—in our product development processes to reduce emissions.

Information disclosure based on TNFD

The IDEC Group has been disclosing information in accordance with TCFD since 2021 and has been disclosing information in accordance with IFRS S2 since 2024, but stakeholder demands are expanding from climate change to include biodiversity and TNFD.

Therefore, starting in fiscal 2025, we have begun preparations to disclose information aligned with the TNFD framework and to identify nature-related issues using the LEAP approach for risk and opportunity assessment.

Utilizing LEAP, we disclose information aligned with the four elements of the TNFD framework: governance, strategy, risk and impact management, and metrics and targets.

The LEAP elements practiced under the TNFD approach are represented by the letters L (Locate), E (Evaluate), A (Assess), and P (Prepare).

The letters and numbers are quoted from “TNFD Approach - LEAP” published in the ‘‘Recommendations of the Taskforce on Nature-related Financial Disclosures.’’

Governance

The board of directors oversees important sustainability matters such as TCFD and TNFD. The Environment Strategy Committee, one of the specialized committees of the Sustainability Environmental Strategy Committee, takes the lead in conducting analysis and evaluation regarding nature-related risks and opportunities, dependencies, and impacts. [P3, P4]

Regarding the evaluation and management system for climate-related and nature-related dependencies, impacts, risks, and opportunities, it is deliberated by the Sustainability Committee, then submitted to the Management Council for reporting and approval and subsequently reported to and approved by the Board of Directors. [P3, P4]

Through regular meetings with the Global Environment Management System steering committee and APEM, we regularly collect information from global bases to grasp region-specific risks. [P3, P4]

Strategy

To organize the relationship between IDEC Group's business activities and their dependence and impact on nature, we conducted a materiality assessment using the external tool "ENCORE."

The dependence and impact items shown by ENCORE are general items common to industries, and some items did not represent analytical results that reflected the characteristics of IDEC Group's specific business activities.

Therefore, from the materiality assessment results, the items with a significant connection to IDEC Group's business activities were selected as water supply for dependency, and CO2 emissions and the discharge of harmful pollutants into water and soil for impact.

Based on the analysis results of ENCORE and the discussions from the workshops, four natural capitals dependent on IDEC's business activities were selected: water, soil, biodiversity, and minerals.

Next, the relationship between IDEC's business activities and natural capital was organized in terms of "dependency × impact."

Next, based on the worldview organized in workshops on risks and opportunities conducted in Japan and in each country and region participating in the global environmental management system, as well as other examination results, items of transitional and physical risks and opportunities expected to reasonably affect the outlook of the IDEC Group were established (please refer to Risk and Impact Management).

Next, for each risk and opportunity item, the time frame (short-term, medium-term, long-term), occurrence probability, and degree of impact were calculated and summarized in a table.

The timeline is set with the short-term ending fiscal 2027, the medium term ending fiscal 2030, and the long-term ending fiscal 2050. [E1]

Dependency and impact on natural capital

| Natural capital | Dependency | Impact | Factors that have impact | |||||

| Atmosphere | Low | Low | Weather conditions, drought, changes in ocean currents, and circulation | |||||

| Land geomorphology | Medium | Medium | Floods, earthquakes, landslides | |||||

| Minerals | Medium | Medium | Changes in Land/Freshwater/Seabed | |||||

| Ocean geomorphology | Changes in Land/Freshwater/Seabed | |||||||

| Soils and sediments | Low | Low | Changes in Land/Freshwater/Seabed, changes in pollutant concentration, changes in species composition | |||||

| Species | Changes in diseases, species composition, and weather conditions | |||||||

| Structural and biotic integrity | Medium | Medium | Floods, changes in land/freshwater/seabed, fires | |||||

| Water | Medium | Medium | Drought, changes in pollutant concentrations, sea level rise | |||||

Risk and impact management

In 2026, workshops on TNFD risks and opportunities are scheduled to be held in the countries and regions participating in the Global Environmental Management System. In the workshops, the identification and impact assessment of risks and opportunities related to natural capital will be conducted. The content of the risk analysis previously conducted in Japan is as follows.

Classification of Nature-Related Risks and Dependencies/Impacts

| Classification | Dependency and influence as contributing factors | Risks and impacts anticipated in the IDEC Group | |||||||||

| Physical risks | Acute | Water flow regulation, storm mitigation | Decline in sales caused by supply chain disruptions due to typhoons and heavy rains | ||||||||

| Chrocic | Water supply, climate regulation | Temporary production stoppage due to water shortage | |||||||||

| Transition risks | Policy | Water purification, Solid waste remediation, soil and sediment retention | Increased costs due to stricter regulations on CO2 emissions and the discharge of harmful pollutants into water and soil. | ||||||||

| Market | Climate regulation | Sales decline caused by decreased demand for products and services | |||||||||

| Technology | Animal-based energy, biomass provisioning | Decline in competitiveness due to technology development falling behind competitors | |||||||||

| Reputational | Ecosystem regulation | Loss of company credibility in cases where negative impacts are caused to the natural environment or ecosystem | |||||||||

| Liability | Water purification, solid waste remediation | Payment of fines and penalties due to violations of laws and regulations | |||||||||

Metrics and Targets

As measurable indicators in IDEC's business activities, we selected four items from the measurement indicators defined by the TNFD.

TNFD's measurement indicators on dependencies and impacts

| Measurement Indicator No. | Drivers of Natural Change | Indicator | Measurement Indicator | Relevant Elements in IDEC | |||||||

| Climate change | GHG emissions | Refer to ISSB's IFRS S2 "Climate-related Disclosures" | CO2 Emissions | ||||||||

| C3.0 | Resource use/ replenishment | Intake and consumption from water-scarce regions | Water withdrawal and consumption70 (m3) from areas of water scarcity, including identification of water source. | Water consumption by site and total | |||||||

| Measurement Indicator No. | Drivers of Natural Change | Measurement Indicator | Relevant Elements in IDEC | ||||||||

| C7,2 | Risks | Description and value of significant fines/penalties received/litigation action in the year due to negative nature-related impacts. | Non-financial indicators listed on IDEC Integrated Report | ||||||||

| C7.4 | Opportunities | Increase and proportion of revenue from products and services producing demonstrable positive impacts on nature with a description of impacts. | Sales of enhanced eco-friendly products | ||||||||